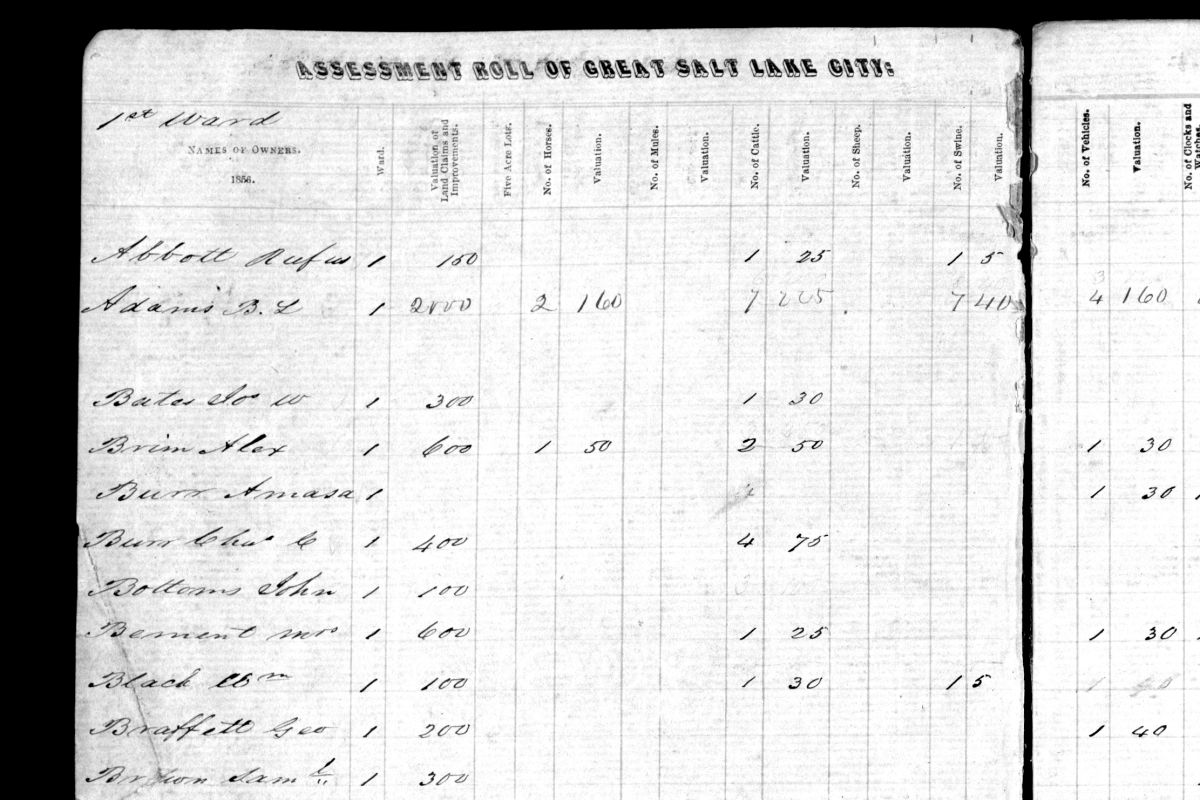

Salt Lake City Tax Assesment Rolls

Utah State Archives Series 4922

These volumes record the assessment of real and personal property. They were used for taxing purposes. Individual city assessors assessed and collected property taxes within municipal boundaries. In 1892, the Territorial Legislature changed the law to require county assessors to assess property for city levied taxes (as well as the usual territorial and county taxes) in incorporated areas. All volumes are labeled Assessment Roll and contain the same information: ward number; name; description of real estate; lot number; block number; letter of plat; value of real estate; value of cattle; value of mules; value of vehicles; value of merchandise; value of stock on national banks; value of gold and silver; taxable credits of bonds; money loaned on hand or deposit; value of personal property; total value; amount of tax; amount remitted or abated by Board of Equalization; amount paid and when paid.

Finding Aids: A series inventory is available.

Page Last Updated June 7, 2016.